Filing Taxes for the Self-Employed US Expats

Self-employed entrepreneurs, contractors, and digital nomads living and working overseas can take advantage of the Foreign Earned Income Exclusion (FEI) if they meet the Bona Fide Residence or Physical Presence test. The FEI exclusion for 2024 is $126,500. Note, the FEI exclusion amount is prorated based on the percentage of deductions you claim against your self-employment income.

If you incur housing costs while living overseas, you may be able to utilize the Foreign Housing Exclusion to reduce your US tax liability.

Just moved to a foreign country? You might be able to deduct moving expenses to reduce your US tax liability.

Self Employed taxpayers are subject to US self-employment taxes on all income foreign income up to the income limitations set for Social Security and Medicare tax. The self-employment tax is 15.3% split into two parts; 12.4% for social security and 2.9% for Medicare. The first $168,600 of tax year 2024 net earnings are subject to the social security portion of the tax. All of your net earnings are subject to the 2.9% Medicare tax.

Note, however, the self-employment tax is calculated on net earnings. Being self-employed, you are treated as a business for tax purposes and thus are eligible to deduct business related expenses. Thus, taxes are calculated on your gross profit or net earnings.

If you are paying income taxes in a foreign country, you may be able to utilize the Foreign Tax Credit in your US tax return which is a dollar-for-dollar reduction in your US income tax liability for foreign income taxes paid.

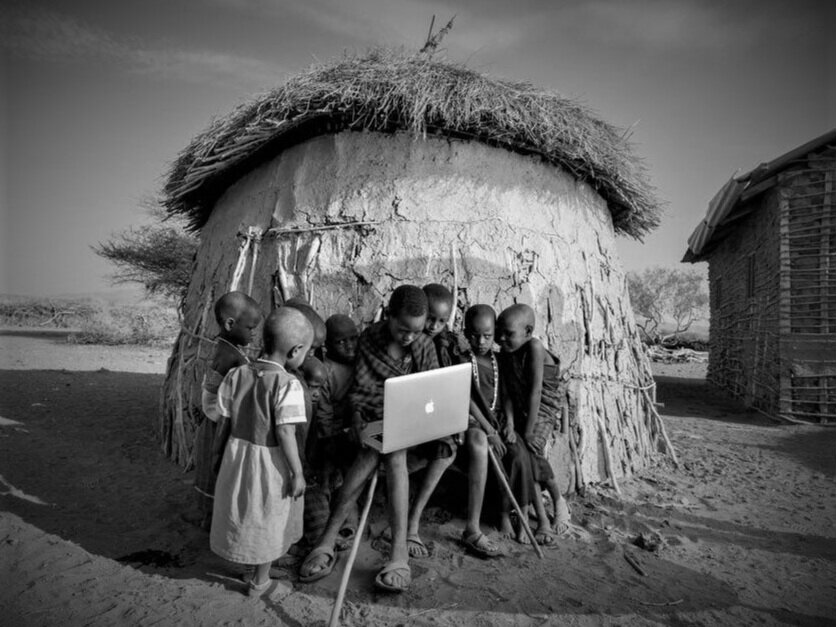

Digital Nomads